It takes a lot of work to create a balance sheet that respects civil and fiscal laws. Accounting is a matter of precision and estimation: two terms that could be easily the opposite of each other. There are amounts that can be immediately determined, for example the amount of invoice received or a paid sum. Other amounts have to be estimated in the best possible way, for the reason the exact to sum to register is not yet known. We are referring to funds, possible future costs or, simply, the value of the goods in a warehouse at a certain date.

The estimation of these values cannot be left to subjective judgment, and over the years rules and principles have emerged to assist in this task. These principles are specified by local or international authorities.

Local authorities have specified through the law the accounting principles that every local company has to adopt, in order to produce the balance sheet and to determine the final amount of taxes to pay. However, they are not currently the only ones available: the IFRS (International Financial Reporting Standards) are considered the best practice in term of accountancy. These international standards should be adopted when the public has interest to see the balance sheet redacted with these principles, for example when a company is listed on an exchange market, or when a company is a subsidiary of another company where IFRS are also used.

The IFRS are redacted by an international authority based in London (IASB) and they consist in:

- An accounting framework, with generic principles to adopt

- Statements about specific topics. This page on wikipedia (http://en.wikipedia.org/wiki/Ifrs) includes a summary description of the framework and the specific statements of IFRS.

The problem arises when the balance sheet have to be redacted using the local rules and the IFRS rules, because they can differ substantially. In fact, two separate accountancies may be necessary, with all the complexity of the case. It’s not only a problem of the big companies, it could be necessary to adopt the international principles even in smaller companies, if they are subsidiary of companies where IFRS are used.

Role of ERP software to assist in multiple ledger management

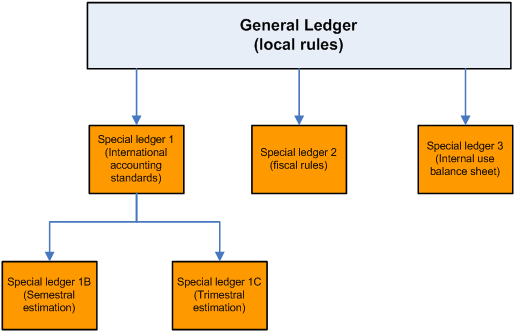

From an accounting point of view, two different sets of accounting principles (local and international) mean producing two separate balance sheets. Application software has a significant role in increasing efficiency in this kind of task, and, specifically, ERP software found a way to resolve this problem, assisting the creation multiple balance sheets for the same company. There are a lot of ERP vendors, and most of them should provide this functionality. The technical terms may differ from one ERP to another, in this article we will use these words:

- General Ledger, to be considered the base of the accounting system. It contains the amounts for a specific company in a operating year. It is considered the official accounting, and from the General Ledger, the balance sheet is built, determining the final result of profit or loss. Most ERP don’t permit direct modification to General Ledger, for the reason this action could be considered an alteration of an official document.

- Special Ledger, as the name suggests, a specialized version of the General Ledger. Special ledger that could adopt a different set of accounting rules and could derive data directly from other ledgers.

As the graphic suggests, the significant advantage of using special ledgers is that they could be derived from general ledger or other specialized ledgers. When transiting the amounts to one ledger to another, specific rules could also be defined to modify attributes or amounts. In this way, it is possible to build an accounting system in parallel, with an official General Ledger accounting representing, for example, the local accounting rules, and other specialized ledgers that represent the international accounting principles or other purposes.

Automation is part of the process: when entering data on the General Ledger, an automatic procedure could update the special ledgers, modifying data in consideration of the rules defined. In this way, you could easily produce, for the most part, two balance sheets at the same time. Of course, manual modification in the single ledger should also be permitted, because the IFRS may consider the inclusion of some values that is necessary to estimate.

The graphic shows also that special ledgers could be used for the infra-annual balance sheet purposes. Without touching the General Ledger, it is possible to copy data directly from this one, and then continue to working in separate way directly on the special ledger, creating the necessary estimated values.

In conclusion, if two different sets of accounting rules have to be used, using these special features might be a good time saving measure. Please refer to our free Get A Shortlist service if you’d like to be matched with ERP software that offers this kind of functionality.

References: